What is Credit Score?

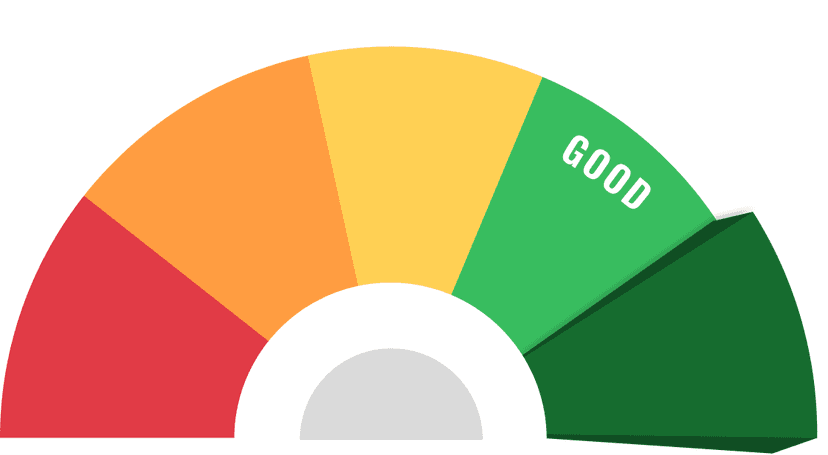

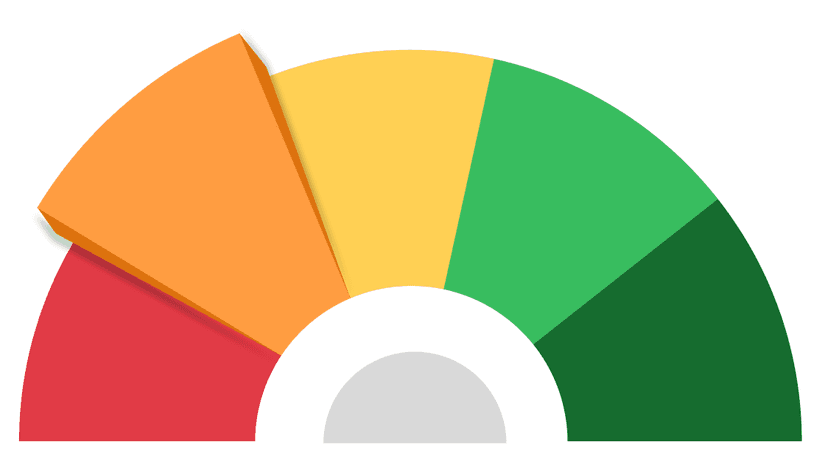

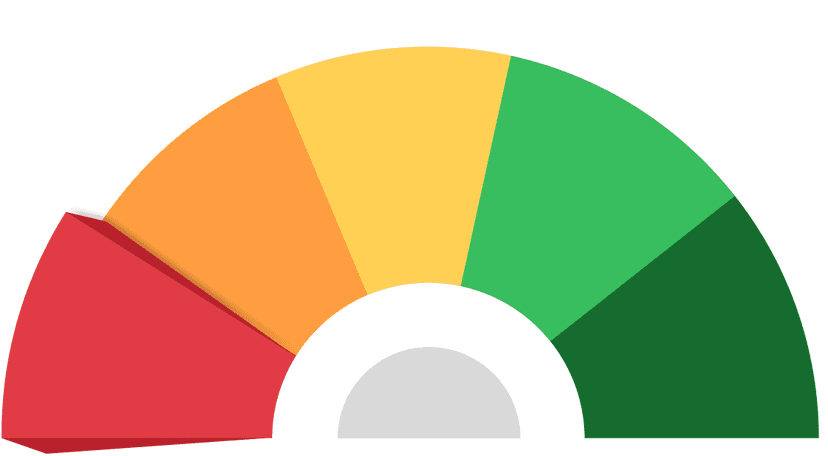

A credit score is a three-digit number that represents your creditworthiness. It helps lenders determine how likely you are to repay a loan on time. The higher your credit score, the better your chances of getting approved for a personal loan or other financial products.

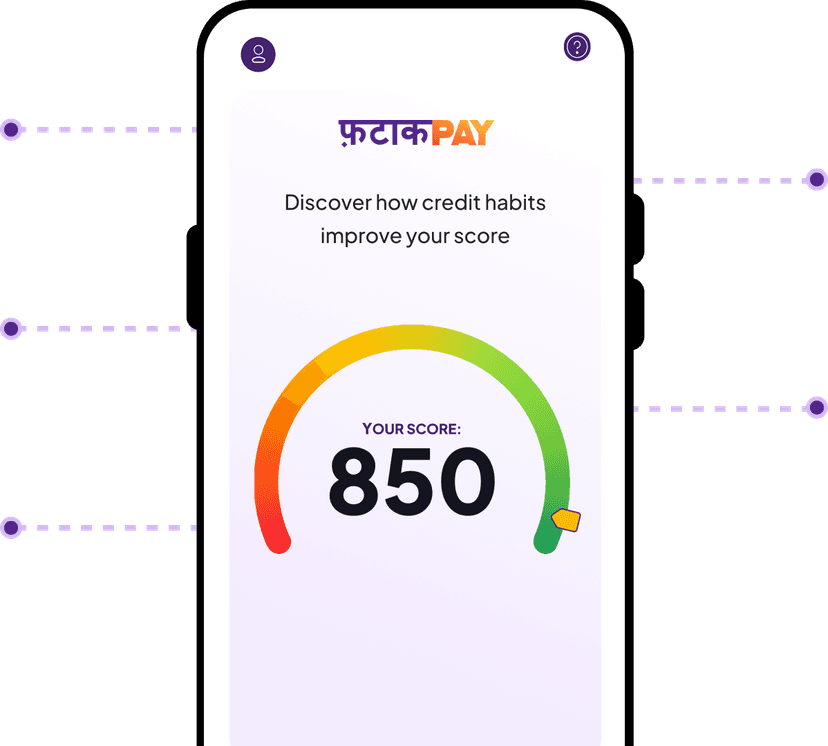

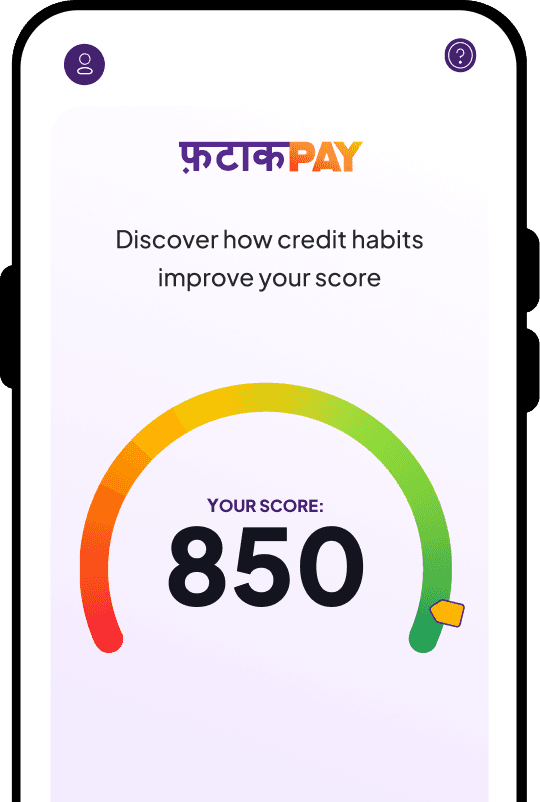

FatakPay simplifies the loan application process, even if you're new to understanding credit scores. Whether you're applying for a loan through an instant loan app or a personal loan app, maintaining a good credit score is essential for securing better terms and lower interest rates.