Monthly Investment

Tenure

Rate of Interest (p.a)

8.5%

This calculator is intended solely for illustrative purposes and does not represent or reflect any FatakPay products.

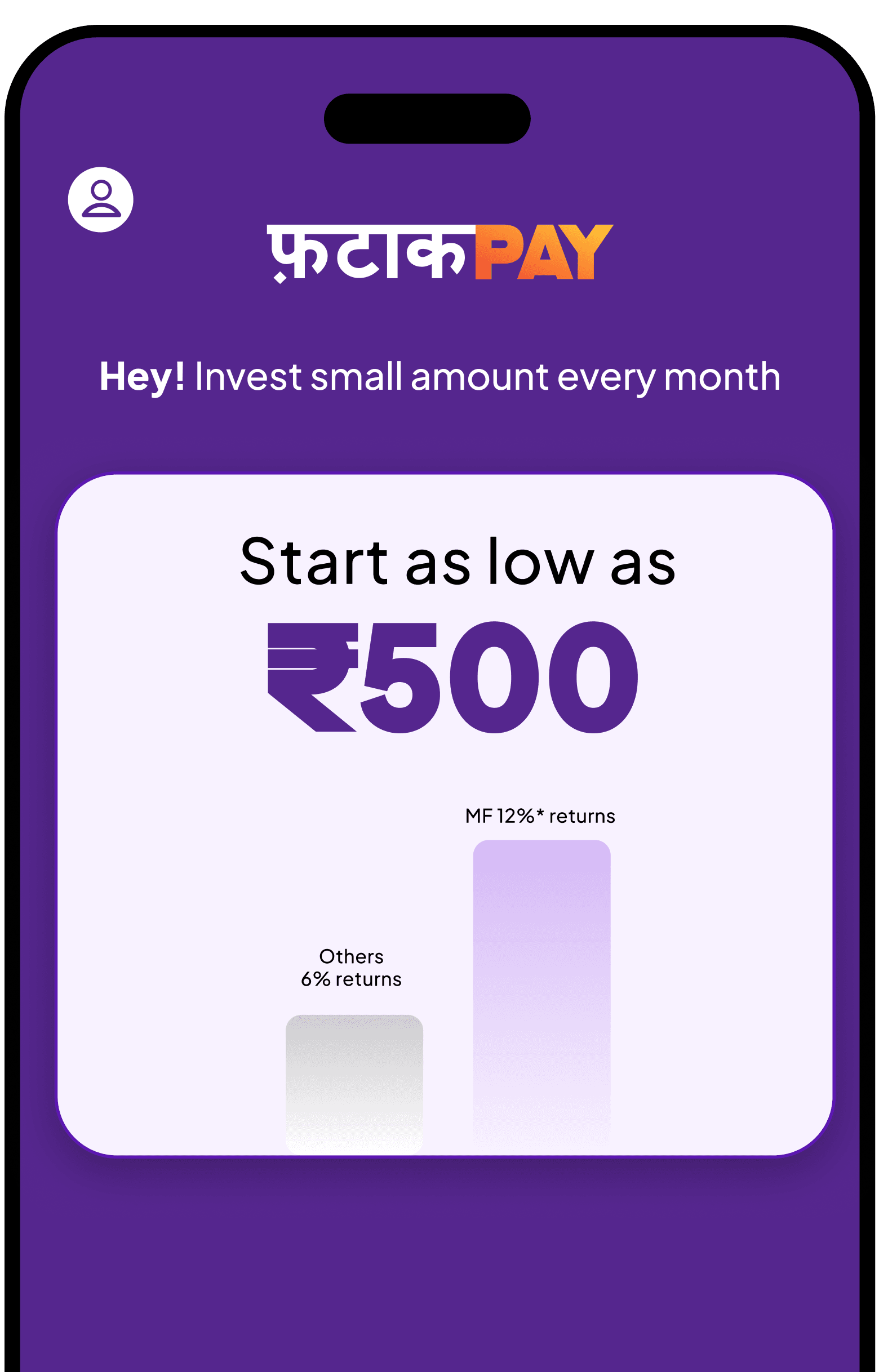

Invest in mutual funds easily and securely with FatakPay, built for your financial goals.

Way to invest in

Mutual Fund with FatakPay?

SIP (Systematic Investment Plan)

SIPs offer a flexible and disciplined approach to investing, enabling you to invest a fixed amount at regular intervals—monthly, quarterly, or weekly.

Lumpsum Investments

Lumpsum investments are ideal for those with surplus funds looking for long-term growth. However, they require careful market timing and may carry higher risk due to market volatility.

Potential for High Returns

Especially in equity mutual funds, there is a higher potential for long-term growth compared to traditional savings instruments.

Liquidity

Most mutual funds offer high liquidity, allowing you to redeem your investments on any business day without significant delays.

Accessibility and Affordability

With options like SIPs, you can start investing in mutual funds with small amounts, making them accessible and affordable for everyone.

Transparency

Mutual funds are regulated by SEBI (Securities and Exchange Board of India) and provide regular updates on fund performance, ensuring transparency.

Diversification

Mutual funds spread your investment across a variety of assets, reducing the impact of market fluctuations on your portfolio.

Professional Management

Funds are managed by experienced professionals who analyze market trends and make strategic investment decisions on your behalf.

Mutual Fund Calculator

Monthly Investment

Tenure

Rate of Interest (p.a)

8.5%

This calculator is intended solely for illustrative purposes and does not represent or reflect any FatakPay products.

01

Download the

FatakPay App

Begin your journey by downloading the FatakPay app from the Play Store or App Store.

02

Explore

Mutual Funds

Once you’re on the app, navigate to the "Mutual Funds" section.

03

Start Your

Investment Journey

Click on Start An SIP and begin building your wealth today.

What are mutual funds and how do they work?

Does FatakPay offer mutual fund investments directly?

What are the ways to invest in mutual funds on FatakPay?

Do I need a lot of money to start investing?

Is it safe to invest through FatakPay?

Read More

Because your financial journey deserves the right advice.

Know the Difference:..

Gold has long been considered a reliable form of investment, offering safety during market volatility and inflation. ...

Financial Wellness:...

Financial wellness is an umbrella term that refers to effectively managing your economic life, and it encompasses a ...

Struggling to attract ...

Apart from the struggles of a dynamic business environment, an organization’s biggest struggle is in attracting and retaining...